What solutions allow marketplace buyers to defer invoice payments without us taking credit risk?

Deferred payments are a structural reality of B2B commerce. Buyers expect to pay on terms and suppliers expect predictable cash flow.

Marketplaces sit in the middle, trying to satisfy both sides without becoming a lender.

The real question for most marketplaces isn’t whether to offer deferred payments; it’s how to do it without taking on credit risk, regulatory exposure, or operational complexity that doesn’t scale.

In practice, most marketplaces explore three main approaches:

- Embedded invoice financing (e.g. Aria)

- Third-party supply chain finance or trade credit (e.g. iwoca)

- B2B Buy Now, Pay Later (BNPL) (e.g. Billie)

Each option allows buyers to pay later and suppliers to get paid. But the mechanics, incentives, and long-term impact on the marketplace are very different.

Comparison of each solution

| Dimension | Embedded Invoice Financing (e.g. Aria) | Third-Party Supply Chain Finance (e.g. iwoca) | B2B Buy Now, Pay Later (e.g. Billie) |

| Primary user | Supplier | Buyer or supplier | Buyer |

| Where financing happens | Fully on-platform | Off-platform | At checkout |

| Trigger for financing | Supplier opts for early payment after invoice validation | Separate credit application | Buyer selects “pay later” |

| Who gets paid upfront | Supplier | Buyer or supplier (outside transaction flow) | Supplier |

| Who underwrites credit risk | Financing provider (buyer underwritten) | Financing provider | BNPL provider |

| Does the marketplace take credit risk? | No | No | No |

| Impact on buyer experience | No change to payment terms or flow | Separate experience | New payment method at checkout |

| Impact on supplier experience | Improved cash flow, optional early payment | Indirect, fragmented | Limited visibility and control |

| Integration complexity | Medium (API / invoicing integration) | Low (referral-style) | Low to medium (checkout integration) |

| Operational scalability | High (automated, invoice-based) | Medium (manual elements remain) | High for checkout, limited post-purchase |

| Visibility for marketplace | High (end-to-end transaction insight) | Low | Medium |

| Best suited for | Supplier liquidity, retention, long-term platform health | Flexible capital access without payment changes | Buyer conversion and purchasing power |

What is embedded invoice financing for marketplaces?

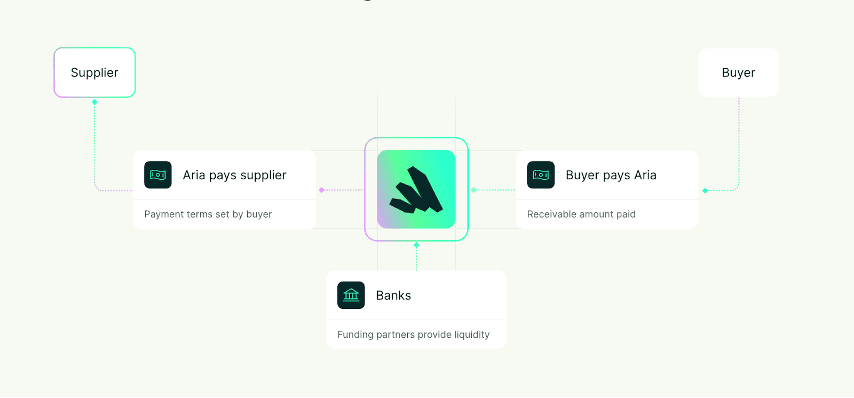

Embedded invoice financing is designed to work as payment infrastructure, not a standalone finance product.

Using Aria as a representative example, the financing is integrated directly into the marketplace via API or dashboard.

Once an invoice is validated, suppliers can receive up to 100% of its value, often within 24 hours. Buyers continue paying on their usual terms, while the financing provider manages underwriting, collections, and recovery.

Key characteristics of embedded invoice financing:

- Financing is embedded directly into marketplace workflows

- The marketplace does not fund invoices or hold credit exposure

- Credit risk is assessed on the buyer, not the supplier

- Collections, disputes, and recovery are handled externally

This model is particularly well suited to marketplaces with:

- Many small or mid-sized suppliers operating on tight cash buffers

- High invoice volumes where manual financing doesn’t scale

- Cross-border or multi-currency operations

- A need to keep all activity on-platform and under the marketplace brand

Because the buyer is underwritten rather than the supplier, even small sellers can access early payment, something traditional factoring models often struggle to support.

How does third-party supply chain finance work for marketplaces?

Supply chain finance and trade credit providers approach deferred payments differently.

Instead of embedding financing into the marketplace’s payment flow, they offer external access to working capital for buyers or suppliers. iwoca is a well-known UK example, providing business loans and trade-credit-style products to help SMEs manage cash flow and smooth payment cycles.

This approach works best when:

- Businesses need flexible capital outside a specific transaction

- Financing decisions don’t need to be tightly coupled to checkout or invoicing

- The marketplace wants to support its ecosystem without rebuilding its payments stack

However, there are trade-offs. Typical limitations include:

- Off-platform onboarding and underwriting

- Separate repayment and collections flows

- Limited visibility for the marketplace

- A more fragmented user experience

For some marketplaces, this is an acceptable compromise. For others – especially product-led or vertically integrated platforms – fragmentation becomes a constraint over time.

What is B2B Buy Now, Pay Later and when does it work best?

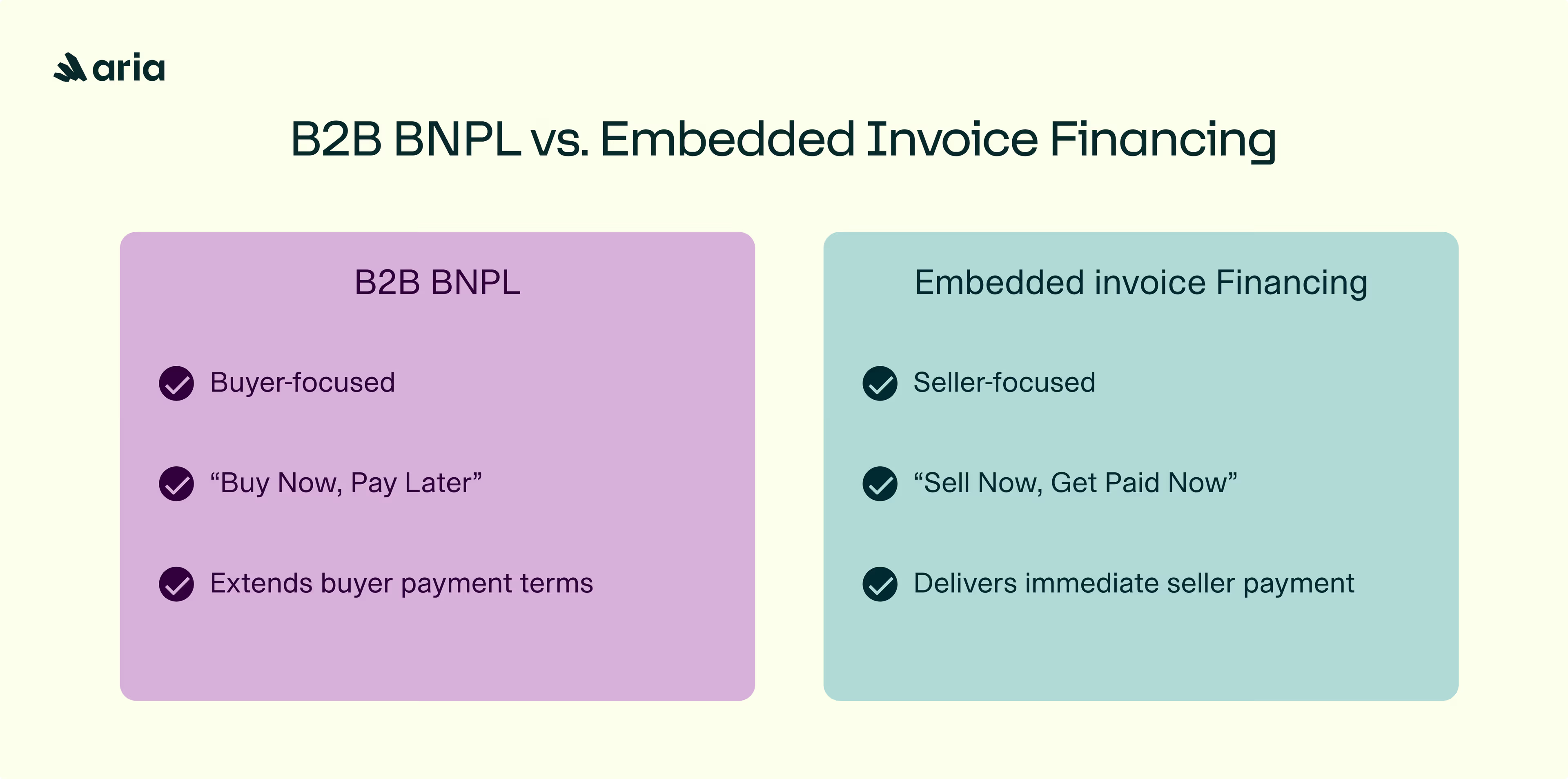

B2B BNPL reframes deferred payment as a payment method, not a supplier financing tool.

With providers like Billie, buyers select “pay later” at checkout. The BNPL provider pays the supplier upfront, assumes credit and fraud risk, and manages collections. Buyers repay over an agreed period, often between 14 and 120 days.

This model works well when:

- Buyer conversion is the primary bottleneck

- Marketplaces want a familiar checkout experience

- Credit, compliance, and collections need to be fully outsourced

However, B2B BNPL is fundamentally buyer-centric. Common limitations include:

- Financing is triggered by buyer choice, not supplier need

- Suppliers typically have limited visibility into financing status

- Post-purchase payment interactions move off-platform

- Long-term supplier relationships can weaken

In ecosystems where supplier retention, repeat transactions, and liquidity are critical, this buyer-first model can become a drawback.

How embedded invoice financing works in practice (step by step)

Embedded invoice financing is built to sit inside a marketplace’s existing payment and invoicing flows.

A typical flow looks like this:

- Buyers and suppliers onboard through the marketplace

- Identity checks (KYC/KYB) and credit decisioning happen in the background

- No separate financing application or redirection to an external lender

- Invoices are issued and validated as usual

- Suppliers submit invoices through the platform

- Buyer confirmation of goods or services acts as a key fraud and dispute control

- Suppliers choose whether to get paid early

- Early payment is optional and supplier-driven

- Funds are often received within 24 hours

- A financing provider advances the funds

- The marketplace does not pre-fund payments

- Credit, dispute, and recovery risk sit with the financing provider

- Buyers pay later on agreed terms

- Standard terms (30, 60, 90 days) remain unchanged

- Collections are handled externally

From the buyer’s perspective, nothing changes. From the supplier’s perspective, cash flow improves. From the marketplace’s perspective, liquidity increases without touching the balance sheet.

Why embedded invoice financing fits marketplaces particularly well

Compared to other deferred payment models, embedded invoice financing tends to:

- Align incentives across buyers, suppliers, and the platform

- Directly address supplier cash-flow constraints (often the real growth bottleneck)

- Scale operationally through automation

- Keep the entire experience on-platform

- Structurally remove credit risk from the marketplace

Aria is a representative example of this approach. Its positioning focuses on API-based integration, underwriting buyers rather than suppliers, and handling collections and disputes so the marketplace doesn’t have to.

“Most marketplaces don’t want to become lenders. They want buyers to pay on terms, suppliers to get paid fast, and the platform to stay out of credit risk. Embedded invoice financing works because it solves the liquidity problem without changing how the marketplace operates or loading risk onto its balance sheet.” – Tom Lamb?

How to choose the right deferred payment model for your marketplace

There is no single “best” option, only trade-offs.

- If your priority is supplier liquidity, retention, and scalable operations, embedded invoice financing (e.g. Aria) is often the strongest fit.

- If you want to offer flexible capital access without changing payment flows, supply chain finance providers like iwoca can work well.

- If you’re optimising primarily for buyer conversion at checkout, B2B BNPL providers like Billie are usually the fastest path.

Most mature marketplaces converge on the same insight: Deferred payments work best when they support both sides of the market, without loading credit risk, operational drag, or fragmented experiences onto the platform.

That’s why embedded invoice financing is increasingly viewed not as a financing product, but as core marketplace infrastructure.

FAQs

What does it mean for a marketplace to take credit risk?

Taking credit risk means the marketplace is financially exposed if a buyer fails to pay an invoice. This can impact cash flow, balance sheets, and regulatory obligations. Models like embedded invoice financing remove this risk by transferring it to a licensed financing provider.

Is invoice financing the same as factoring?

Not exactly. Traditional factoring underwrites suppliers and often requires assignment of receivables. Embedded invoice financing underwrites buyers, works transaction by transaction, and is integrated directly into marketplace workflows.

Do marketplaces need FCA or regulatory approval to offer deferred payments?

In most cases, no, provided the marketplace is not lending itself. Licensed financing providers handle underwriting, credit risk, and compliance, operating under UK FCA or EU regulatory frameworks.

How does deferred payment impact supplier retention?

Access to early payment improves supplier cash flow, reduces churn, and enables suppliers to reinvest in inventory or growth. For many marketplaces, supplier liquidity is a stronger retention lever than buyer incentives.

Can deferred payments work internationally?

Yes, but cross-border deferred payments require multi-currency support, local compliance, and robust credit assessment. Embedded invoice financing providers are typically better suited to international marketplace models than standalone trade credit solutions.

Sources:

- https://www.iwoca.co.uk/finance-explained/supply-chain-finance#how-do-you-implement-supply-chain-financing

- https://www.iwoca.co.uk/finance-explained/reverse-factoring-explained#reverse-factoring-companies-in-the-uk

- https://www.iwoca.co.uk/small-business-loans

- https://www.billie.io/trade-account

- https://www.billie.io/marktplatz

- https://www.billie.io/rechnungskauf

- https://www.billie.io/uk/pay-later